The Importance of Bank Statements for Individuals and Businesses

Bank statements are more than just a record of financial transactions—they are a vital tool for managing your finances, ensuring accuracy, and supporting long-term financial health. For individuals and businesses alike, regularly reviewing and understanding bank statements is essential for budgeting, tax preparation, and maintaining financial accountability. This blog explores the importance of bank statements and how to use them effectively.

What Are Bank Statements?

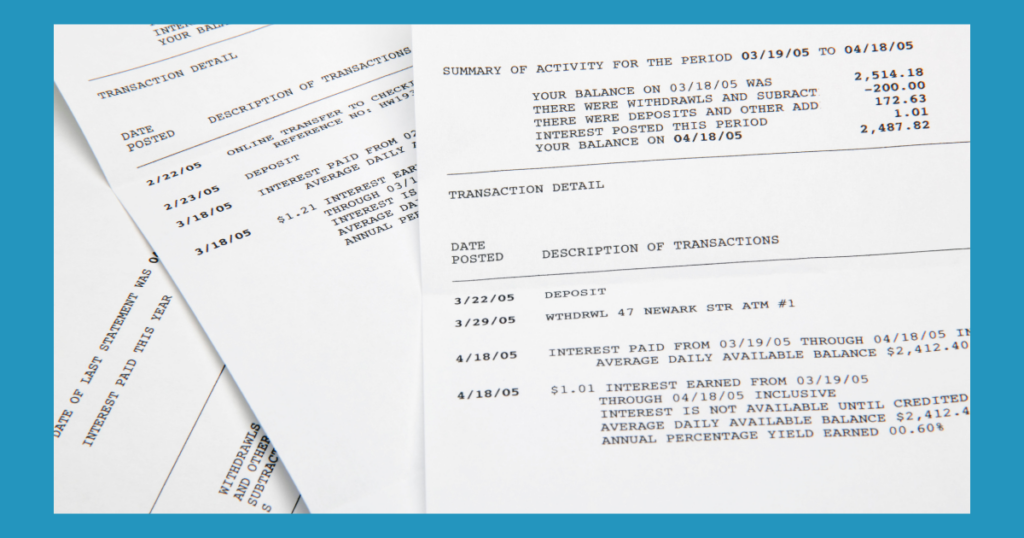

A bank statement is a detailed summary of all financial transactions within a specific period, typically monthly. It includes:

- Deposits and withdrawals

- Checks cleared

- Automated transactions (ACH transfers)

- Fees and penalties

- Current account balance

Bank statements are issued by banks to account holders and serve as an official record of activity in your account.

Why Are Bank Statements Important?

1. Financial Accountability

Bank statements provide a clear picture of your income, expenses, and overall financial health. By reviewing them regularly, you can:

- Identify spending habits

- Monitor savings growth

- Ensure your financial goals are on track

2. Tax Preparation

For individuals and businesses, bank statements are indispensable during tax season. They help:

- Verify income and deductible expenses

- Reconcile financial records

- Provide documentation in case of an IRS audit

Tip: Retain your bank statements for at least three years for tax purposes.

3. Fraud Detection

Regularly reviewing bank statements can help you quickly spot unauthorized transactions or fraudulent activity.

Signs of Fraud:

- Unknown charges

- Duplicate transactions

- Missing deposits

Tip: Notify your bank immediately if you notice suspicious activity.

4. Budgeting and Financial Planning

Bank statements provide insights into your spending patterns, enabling you to create realistic budgets and financial plans.

For Individuals:

- Identify unnecessary expenses to cut back on.

- Allocate funds more effectively toward savings and investments.

For Businesses:

- Monitor cash flow.

- Plan for upcoming expenses or investments.

5. Supporting Loan Applications

When applying for a loan or mortgage, banks often require several months of bank statements to assess your financial stability.

Key Metrics Evaluated:

- Income consistency

- Spending habits

- Current account balance

Tip: Keep your bank account in good standing to improve your chances of loan approval.

6. Reconciliation and Record-Keeping

Bank statements are essential for reconciling your accounts and ensuring your records match the bank’s.

For Businesses:

- Reconcile your bank statement with your bookkeeping records monthly.

- Identify discrepancies like missed transactions or bank errors.

For Individuals:

- Cross-check your bank statement with your personal budget or tracking app.

How to Use Bank Statements Effectively

1. Review Regularly

Make it a habit to review your bank statements each month. Look for patterns, inconsistencies, or opportunities to save.

2. Organize Your Statements

Keep digital or physical copies of your bank statements in an organized manner. Use folders labeled by year and month for easy reference.

Tip: Many banks offer downloadable statements in PDF format—store them securely on your computer or cloud storage.

3. Use for Tax Deduction Tracking

For businesses, bank statements are a key source for identifying deductible expenses like travel, office supplies, or marketing costs.

4. Monitor Business Cash Flow

For entrepreneurs, bank statements are a lifeline for understanding cash flow. Use them to:

- Analyze trends in income and expenses.

- Identify periods of surplus or shortfall.

5. Plan for Large Expenses

By reviewing your statements, you can forecast future expenses and ensure sufficient funds are available.

Common Mistakes to Avoid

1. Ignoring Bank Statements

Failing to review bank statements regularly can lead to missed errors or opportunities to save.

2. Not Reconciling Accounts

For businesses, neglecting account reconciliation can result in inaccurate financial records, affecting budgeting and tax reporting.

3. Overlooking Fees

Bank statements often list fees for account maintenance or overdrafts. Monitoring these fees can help you switch to a more cost-effective account.

Digital Bank Statements: A Modern Convenience

Most banks now offer digital statements, providing several benefits:

- Eco-Friendly: Reduces paper waste.

- Convenient: Accessible anytime through online banking portals.

- Secure: Many banks use encryption to protect digital statements.

Tip: Ensure your login credentials are strong and secure to protect your financial information.

Bank statements are a cornerstone of financial management, offering valuable insights into your income, expenses, and overall financial health. Whether you’re budgeting, reconciling accounts, preparing taxes, or applying for a loan, reviewing and understanding your bank statements is essential. Make it a priority to incorporate regular bank statement reviews into your financial routine to stay organized, secure, and financially prepared.

Subscribe to our newsletter to receive our latest blog directly to your inbox.