The Importance of Tax Preparation: A Guide for Individuals and Businesses

Tax preparation is more than just filing paperwork—it’s a vital part of your financial health. Proper tax preparation helps avoid costly mistakes, maximize deductions and credits, and ensure compliance with ever-changing tax laws. Whether you’re an individual or a business owner, staying organized and planning ahead can save you time, reduce stress, and improve your financial outcomes.

The Importance of Keeping Business and Personal Finances Separate

Mixing business and personal finances can lead to tax complications, legal risks, and financial disorganization. Keeping them separate ensures financial clarity, protects personal assets, simplifies tax preparation, and enhances business credibility. By opening a business bank account, using a dedicated credit card, and maintaining clear records, you can safeguard your business and personal wealth.

The Legal and Tax Benefits of Registering Your Business

Registering your business offers more than just legitimacy—it provides vital legal protections and significant tax advantages. From personal liability protection to access to tax deductions, benefits like pass-through taxation and eligibility for retirement plans can support your business’s growth and stability.

The Importance of an Annual Report for Your Business

An annual report goes beyond summarizing financial performance—it’s a vital tool for transparency, trust, and strategic growth. From financial statements to future goals, it provides stakeholders with a clear understanding of your business’s health and direction. A well-crafted report not only ensures compliance but also enhances your brand image and supports informed decision-making.

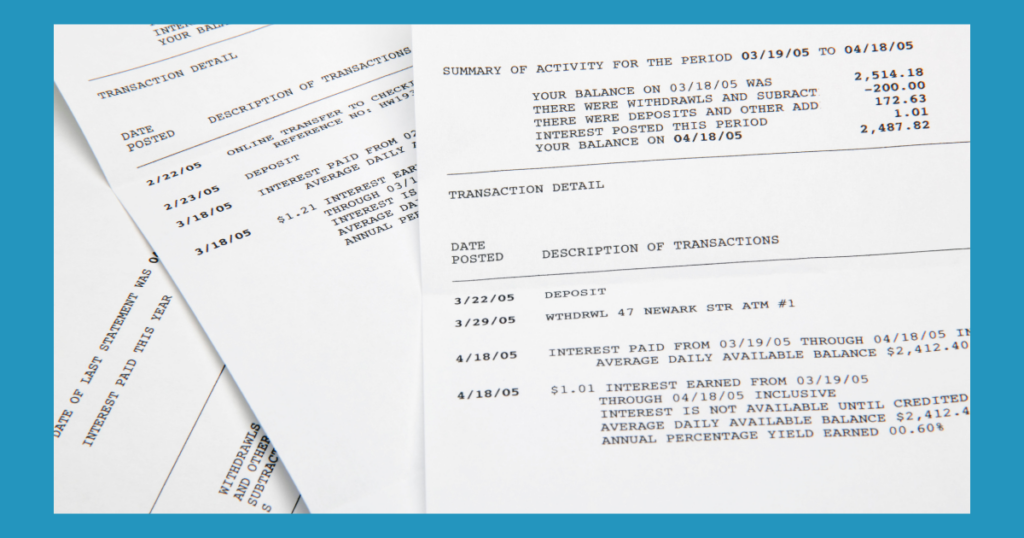

The Importance of Bank Statements for Individuals and Businesses

Bank statements are more than transaction records—they’re a vital tool for financial management. For individuals and businesses, reviewing bank statements helps track expenses, detect fraud, prepare for taxes, and improve budgeting. They’re essential for maintaining financial accountability and ensuring accuracy in bookkeeping and planning.

Mastering Budgeting: A Guide to Financial Freedom

Struggling to track where your money goes? You’re not alone—65% of people don’t follow a budget, leading to financial stress. Budgeting is the solution, offering clarity, debt reduction, and peace of mind. Whether saving for a milestone or tackling debt, a well-structured budget can transform your financial future.

The Role of a CPA in Business Succession Planning

Planning for the future of your business is essential, and a CPA plays a critical role in ensuring a smooth transition. From tax optimization to valuation and financial structuring, CPAs provide expert guidance to help secure your legacy and minimize potential challenges. Whether you’re passing your business to a family member or preparing for a sale, a CPA ensures every aspect is strategically planned.

Converting an LLC to a C-Corporation and the QSBS Reasons to Do It

Converting your LLC to a C Corporation can unlock significant tax benefits, including eligibility for the Qualified Small Business Stock (QSBS) exclusion. This strategic move is ideal for businesses seeking to attract investors, scale operations, or leverage tax advantages.